When shopping for car insurance, understanding your coverage options is key to securing the best rates. A thorough comparison goes beyond price, delving into essential protections like liability, collision, and comprehensive. This guide navigates the process, empowering you to use online tools and calculators for efficient auto insurance quote comparisons. We explore different policy types, highlighting key elements to consider for a comprehensive plan that offers cost-effective protection without sacrificing quality.

- Understanding The Importance of Car Insurance Coverage Comparison

- Decoding Different Types of Car Insurance Policies

- Utilizing Online Tools for Efficient Auto Insurance Quote Comparison

- Key Elements to Consider in a Comprehensive Car Insurance Policy

- Navigating Liability, Collision, and Other Common Coverage Options

- Securing the Best Car Insurance Rates: Strategies for Cost-Effective Protection

Understanding The Importance of Car Insurance Coverage Comparison

Understanding the importance of car insurance coverage comparison is paramount in securing adequate protection for your vehicle and yourself. In today’s digital era, comparing auto insurance quotes has become more accessible than ever before. Online tools and calculators enable policy seekers to effortlessly delve into the intricacies of various policies, thereby facilitating an informed decision-making process. By meticulously evaluating options, individuals can identify coverage gaps and ensure they obtain the best car insurance rates tailored to their specific needs.

This comparison goes beyond simply focusing on price tags; it entails assessing liability, collision, comprehensive, and other specialized coverages. A thorough analysis allows drivers to choose policies that offer comprehensive protections, including medical payments, uninsured/underinsured motorist coverage, and roadside assistance—all of which can make a significant difference in the event of an accident or unexpected vehicle damage. With access to cheap car insurance comparison platforms, navigating through different plans becomes less daunting, ultimately helping folks find suitable coverage at competitive auto insurance rates.

Decoding Different Types of Car Insurance Policies

Decoding Different Types of Car Insurance Policies is a crucial step in finding the best car insurance rates. When comparing auto insurance quotes, understanding the various coverage options becomes essential. Policies differ primarily in their scope and cost, catering to diverse driving needs and budgets. Liability coverage protects against financial loss in case of accidents caused by you, while comprehensive and collision coverages safeguard your vehicle from damages, including theft and weather events.

Online car insurance quotes tools make this process efficient. You can easily access and compare different policy offerings from various providers. These platforms provide a cheap car insurance comparison, allowing you to assess the auto insurance rate for each option. By carefully examining the coverage details and deductibles, you can determine which policy offers the best balance between protection and cost for your specific situation.

Utilizing Online Tools for Efficient Auto Insurance Quote Comparison

In today’s digital era, navigating car insurance options has become easier thanks to a plethora of online tools and calculators. These platforms allow users to efficiently compare auto insurance quotes from multiple providers within minutes. By inputting personal details, vehicle specifications, and desired coverage levels, individuals can gain instant access to competitive best car insurance rates in the market. This streamlined process enables consumers to make informed decisions without the hassle of contacting each insurer individually.

Cheap car insurance comparison websites are designed to simplify the often complex task of evaluating different policies. They offer a comprehensive overview of various coverage options, including liability, collision, comprehensive, and more. Users can filter results based on their specific needs, whether they prioritize low-cost premiums or seek extensive protection. This efficient auto insurance quote comparison ensures individuals secure the most suitable policy aligned with their budget and requirements, ultimately saving them time and potentially significant financial savings.

Key Elements to Consider in a Comprehensive Car Insurance Policy

When comparing car insurance policies, several key elements should be at the forefront of your consideration. Firstly, assess liability coverage, which protects against claims arising from accidents caused by you. This includes property damage and personal injury liability. Understanding the limits and types of liability covered is crucial for ensuring adequate protection.

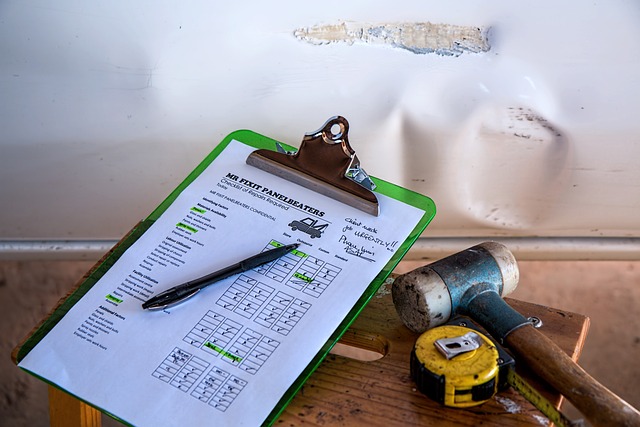

Secondly, consider comprehensive and collision coverage. These options protect against a wide range of events beyond your control, such as theft, vandalism, natural disasters, or accidents involving uninsured or underinsured drivers. Comprehensive coverage typically includes these perils, while collision coverage focuses on damage to your vehicle from an accident. Online car insurance quote tools and calculators allow you to easily compare cheap car insurance comparison options based on these criteria, helping you secure the best car insurance rates tailored to your needs. By leveraging these resources, you can make informed decisions when navigating auto insurance rate comparison.

Navigating Liability, Collision, and Other Common Coverage Options

Navigating the world of car insurance can be a complex task, but understanding the key coverage options is essential for finding the best rates. When comparing auto insurance quotes, it’s crucial to pay attention to liability, collision, and additional coverage types. Liability insurance protects you against claims made by others if you’re found at fault in an accident, covering medical expenses and legal fees. Different policies offer varying levels of liability coverage, so it’s important to consider your financial situation and potential risks on the road.

Collision coverage is another vital component, shielding your vehicle from damage incurred during a crash. This type of insurance can help pay for repairs or even replacement costs if your car is damaged. When comparing cheap car insurance rates, assess whether you need collision coverage based on your driving history, vehicle age, and personal financial situation. Online car insurance quotes and calculators make this process easier by allowing you to instantly compare various coverage options and find the best auto insurance rate tailored to your specific needs.

Securing the Best Car Insurance Rates: Strategies for Cost-Effective Protection

Securing competitive car insurance rates doesn’t have to be a daunting task. One of the most effective strategies is to leverage online tools for comparing auto insurance quotes from multiple providers. These platforms allow you to input your personal information, vehicle details, and desired coverage levels to generate instant, side-by-side comparisons. By taking this approach, you can quickly identify the best car insurance rates that align with your budget and protection needs.

Moreover, actively shopping around for quotes regularly can help keep your rates low. Insurance providers frequently adjust their pricing strategies, so comparing auto insurance quotes every few months can reveal more affordable options. Additionally, maintaining a clean driving record, avoiding claims, and bundling policies (such as combining auto and home insurance) are proven ways to reduce costs on your car insurance premium.

In navigating the complex landscape of car insurance, understanding coverage options is key to securing the best rates without compromising protection. By comparing auto insurance quotes using online tools and calculators, you can decipher different policy types, evaluate key elements like liability and collision coverage, and identify cost-effective strategies. This comprehensive approach ensures you find the perfect balance between comprehensive protection and affordable premiums, ultimately providing peace of mind on the road ahead. Remember, a thorough cheap car insurance comparison is your gateway to smarter, more secure driving.