Understanding your coverage needs is crucial when shopping for car insurance. This comprehensive guide helps you navigate the various options available, ensuring you get the best auto insurance rates tailored to your situation. We’ll break down essential elements like liability and comprehensive coverage, leveraging online tools and calculators for an efficient comparison. Learn how to interpret quotes, uncover policy limitations, and make informed decisions to secure cheap car insurance, making your journey towards responsible driving smoother than ever.

- Defining Coverage Needs: Understanding Liability and Comprehensive Insurance

- The Role of Online Tools in Auto Insurance Comparison

- Unveiling the Components of a Comprehensive Car Insurance Policy

- Strategies for Securing Affordable Car Insurance Rates

- Interpretating Auto Insurance Quotes: What to Look For

- Navigating Exclusions and Limitations in Car Insurance Policies

- Making Informed Decisions: Best Practices for Comparing Car Insurance Policies

Defining Coverage Needs: Understanding Liability and Comprehensive Insurance

When comparing car insurance policies, defining your coverage needs is a crucial first step. Understanding liability and comprehensive insurance is essential for any driver looking to secure the best car insurance rates. Liability insurance protects you financially if you cause damage to someone else’s property or injure them while driving. It covers medical expenses, legal fees, and other costs associated with accidents. Comprehensive insurance, on the other hand, protects your vehicle from non-accident related damages such as theft, vandalism, natural disasters, and animal strikes.

By evaluating these two types of coverage, you can create a balanced approach that ensures both your financial protection and your vehicle’s safety. Online car insurance quotes tools make this process easier by allowing you to compare auto insurance quotes from multiple providers side-by-side. These platforms help drivers navigate the complex landscape of insurance options, ultimately leading to a cheap car insurance comparison that meets their specific needs.

The Role of Online Tools in Auto Insurance Comparison

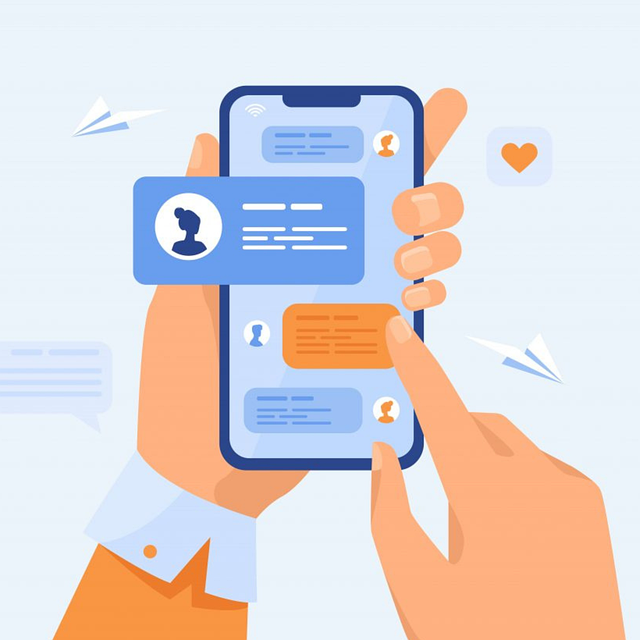

In today’s digital era, online tools and calculators play a pivotal role in simplifying the complex process of comparing car insurance policies. These platforms allow users to input their personal information, vehicle details, and desired coverage options to receive multiple auto insurance quotes from various providers. By leveraging these resources, individuals can efficiently compare cheap car insurance and identify the best rates tailored to their specific needs.

The convenience offered by online tools is immense, enabling policyholders-to-be to quickly assess different comprehensive car insurance coverage options without the hassle of contacting each insurer individually. Moreover, these platforms often provide detailed breakdowns of coverage, deductibles, and potential savings, making it easier for consumers to navigate the intricate landscape of auto insurance and secure the most suitable protection at competitive best car insurance rates.

Unveiling the Components of a Comprehensive Car Insurance Policy

When exploring the various car insurance policies, understanding the components that make up a comprehensive coverage is key. A thorough breakdown reveals several critical elements, each offering distinct protections for different scenarios. From liability coverage, which shields you from financial responsibility in case of an accident causing harm or damage to others, to comprehensive coverage that safeguards against unforeseen events like theft, vandalism, or natural disasters, these components collectively form the backbone of a robust auto insurance policy.

Online car insurance quotes and comparison tools play a pivotal role in navigating this process. They allow you to access and evaluate multiple policies side by side, effortlessly comparing auto insurance rates and coverage options. By leveraging these digital resources, you can swiftly identify the best car insurance rates tailored to your specific needs and budget, ensuring peace of mind on the road.

Strategies for Securing Affordable Car Insurance Rates

Securing affordable car insurance rates involves a strategic approach to comparing auto insurance quotes. Start by gathering quotes from multiple insurers using online car insurance comparison tools, which make it easy to input your vehicle details and driving history. This initial step allows you to gauge the market rates for your specific needs. Next, carefully review each policy’s coverage options and deductibles to ensure you’re not paying for unnecessary add-ons. Many companies offer discounts on various aspects like safe driver history, bundling policies (home + auto), or maintaining a good credit score, so be sure to ask about these potential savings.

For a cheap car insurance comparison, don’t overlook the impact of your coverage limits. Lowering your liability and collision deductibles might reduce premiums but could also increase out-of-pocket expenses in case of an accident. Find a balance that aligns with your risk tolerance and financial situation. Additionally, consider specific coverages carefully; for example, comprehensive insurance protects against non-crash events like theft or natural disasters, but it may not always be necessary depending on where you live and your vehicle’s age. Using these strategies, you can navigate the process of comparing auto insurance quotes effectively to secure the best car insurance rates tailored to your budget and needs.

Interpretating Auto Insurance Quotes: What to Look For

When comparing auto insurance quotes, understanding what each policy covers is only half the battle. You also need to interpret the numbers and percentages presented in a way that makes sense for your situation. Look beyond the initial price tag; delve into the details of each quote. What coverage limits are offered? Do they align with your needs or do you require higher limits for comprehensive or collision damages? Consider the types of deductibles associated with each policy—higher deductibles often mean lower premiums, but it’s crucial to ensure you can comfortably afford them in case of an accident.

Online car insurance quote calculators can be powerful tools during this evaluation process. They allow you to input specific details about your vehicle, driving history, and coverage preferences to generate tailored comparisons. These calculators present side-by-side comparisons, making it easier to identify the best car insurance rates that suit your needs without compromising on protection. Remember, a thorough cheap car insurance comparison is key to securing not just affordable but also adequate auto insurance coverage.

Navigating Exclusions and Limitations in Car Insurance Policies

Navigating exclusions and limitations in car insurance policies is a crucial step when comparing rates. While it’s tempting to focus solely on the bottom line, understanding what’s excluded or limited can significantly impact your coverage. Exclusions detail situations where your policy won’t provide protection, such as high-risk driving, vehicle modifications, or specific weather events. Limitations, on the other hand, may cap the amount of compensation for certain damages or losses. When comparing auto insurance quotes online, carefully review these clauses to ensure the policy aligns with your needs and offers the best car insurance rates for your situation.

A cheap car insurance comparison might seem like a straightforward process, but it’s essential to look beyond the initial price tag. Online car insurance quotes tools make this evaluation easier by allowing you to compare multiple policies side by side. These tools consider various factors, including your driving history, vehicle type, and location, to provide accurate rate estimates. By delving into these details, you can secure comprehensive coverage at competitive rates, ensuring peace of mind on the road.

Making Informed Decisions: Best Practices for Comparing Car Insurance Policies

When comparing car insurance policies, making informed decisions requires a systematic approach. Start by gathering quotes from multiple insurers using online platforms designed for this purpose. These tools allow you to input your vehicle details and personal information once, simplifying the process of obtaining various cheap car insurance comparison estimates. Ensure you’re receiving quotes that are tailored to your specific needs, as generalised online car insurance quotes may not reflect the intricacies of your situation.

Next, carefully review each policy’s coverage options. Understand what is included in the basic package and assess if additional protections align with your requirements. Look beyond just price; consider factors like deductibles, coverage limits, and specific exclusions. A thorough auto insurance rate comparison will help you identify policies that offer comprehensive protection without compromising on quality or affordability, ultimately securing the best car insurance rates for your needs.

When comparing car insurance policies, a strategic approach using online tools and calculators can help you navigate complex options. By understanding your coverage needs, from liability to comprehensive protection, and interpreting quotes thoroughly, you can secure the best car insurance rates tailored to your situation. Remember, a meticulous comparison ensures you’re not overpaying for auto insurance while staying protected. Embrace the power of digital resources and make informed decisions with confidence.